No insurance carrier ever says that they want to increase the number of vendors they employ. Why? Because all that does is increasingly complicate your workflow, both for your underwriting department and the management of those vendors. Conversely, creating and nurturing one partnership with a single inspection vendor not only simplifies the process of getting inspection reports, but provides numerous benefits, including convenience and consistency.

Help your bottom line

Allocating resources and budget constraints are universal concerns for all businesses, including insurance carriers. All carriers would prefer to completely examine their entire book of business regularly, but few have the resources to do that annually. By using a sole inspection vendor, a carrier can fully take advantage of that vendor’s data capabilities, and ultimately save money in the long run by spending your inspection dollars where you really need them.

For example, PreInspectR®, Millennium’s inspection optimization tool, allows insurance companies to judge the likelihood of actionable underwriting concerns within a risk. Relying just on traditional attributes, as employed by other score-based solutions is insufficient. PreInspectR analyzes policy, home, environmental and geographic variables to give a home a comprehensive score using more than 25 years of inspection knowledge and data. Using this score, a carrier can identify those properties that most likely have issues that need either remediation or cancellation, allowing carriers to focus their inspection investments.

Fully utilize ad hoc reporting capabilities

Getting carriers actionable data is the first responsibility of inspection vendors, but how we allow them to manipulate that data and use it to make underwriting decisions is even more important to carriers. Having your entire book of business together within one inspection vendor allows an insurer to fully utilize of this kind of ad hoc reporting capability.

Millennium brings you the most advanced analytics that drive wise, cost-effective decision-making. For example, through our exclusive partnership with FICO®, Millennium has created Property PredictR®, the first statistically developed property risk score based on property inspection data. Property PredictR gives underwriters a snapshot of a particular risk, based on our real property inspection data, and rank-orders a carrier’s properties by loss ratio relativity. It utilizes our vast inspection data archive and looks at dwelling features and conditions, liability concerns, and additional structures to give carriers a clear decision concerning underwriting actions.

Consistency is key

Perhaps the biggest benefit of having a sole inspection vendor is consistency. Consistency is key for an underwriting team. When they work with more than one inspection vendor, they will undoubtedly see variability in the results they receive from their different partners. That lack of consistency presents a number of challenges. Inspectors working for different companies will have undergone different training processes. Therefore, their standards for photos and documentation may differ slightly. Also, the review process for different inspection vendors may not be exactly the same. If all of your surveys are done by the same veteran inspection staff and given the same level of scrutiny by multiple layers of quality review, you can be confident that you have consistency across the board when it comes to your inspections.

Not all vendors are created equal. While it’s best to cultivate a relationship with a sole inspection vendor, you want to put that time and effort into a vendor who will give you convenience, purchasing power leverage, and speed of implementation, all while empowering you with ad hoc reporting capabilities for your book of business. In all of these categories, Millennium consistently beats the competition.

All insurance carriers are not alike. Each one underwrites properties differently, has different priorities regarding remediating different kinds of hazards and issues, has different instructions for inspectors, and so on. One carrier may be concerned with the number of windows in a home and be less concerned with the number of un-railed steps outside of the home. Conversely, another insurer may be less concerned about the stairs or windows, and have a greater concern regarding adjacent structures. Because of these differences in concerns, property inspection providers must approach inspections for various carriers differently. Regardless of which factors they want emphasized, the need for quality inspection results that give them specific data remains paramount. Therefore, a good property inspection business partner will take the time and resources to accommodate a carrier’s particular needs.

All insurance carriers are not alike. Each one underwrites properties differently, has different priorities regarding remediating different kinds of hazards and issues, has different instructions for inspectors, and so on. One carrier may be concerned with the number of windows in a home and be less concerned with the number of un-railed steps outside of the home. Conversely, another insurer may be less concerned about the stairs or windows, and have a greater concern regarding adjacent structures. Because of these differences in concerns, property inspection providers must approach inspections for various carriers differently. Regardless of which factors they want emphasized, the need for quality inspection results that give them specific data remains paramount. Therefore, a good property inspection business partner will take the time and resources to accommodate a carrier’s particular needs.

Investing In Customized Training

There are numerous ways for property inspection providers to accommodate for a carrier’s individual needs. For example, each of Millennium’s clients use one of several replacement cost calculators to obtain replacement costs for their policies. The different attribute types employed by these calculators require that the data gathering on inspections be approached differently depending on the replacement cost tool employed. In order to ensure that inspections meet specific client needs, and in the most efficient way possible, Millennium’s training team has created a series of supplemental training sessions, geared specifically toward each client’s particular needs.

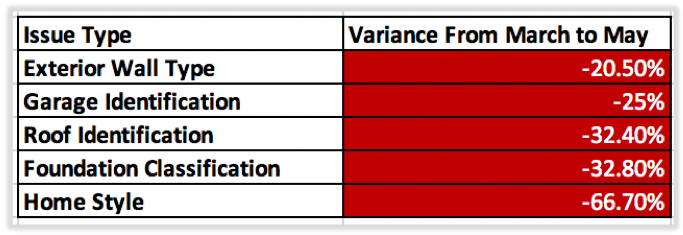

The effectiveness of this additional training resource can be seen in a recent example. A new client had very specific requirements for classifying property attributes, some of which were deviations from what other carriers required for that specific replacement cost tool. Once these differences were recognized by Millennium’s Quality Assurance team, inspectors were enrolled in training sessions that focused on particular areas that were identified as “frequent” by the carrier as a variance from their usage of the tool. These areas included specific construction types, house style definition, and specific exterior wall material classifications. After completing the training session, inspectors were required to take and pass a learning assessment on the material and potentially undergo further specific training with a manager. These specific training sessions were introduced to our field team in March of 2018. Within two months, instances of the issues covered in the sessions decreased overall by 20%, with some of them individually decreasing by more than 60%.

The effectiveness of this additional training resource can be seen in a recent example. A new client had very specific requirements for classifying property attributes, some of which were deviations from what other carriers required for that specific replacement cost tool. Once these differences were recognized by Millennium’s Quality Assurance team, inspectors were enrolled in training sessions that focused on particular areas that were identified as “frequent” by the carrier as a variance from their usage of the tool. These areas included specific construction types, house style definition, and specific exterior wall material classifications. After completing the training session, inspectors were required to take and pass a learning assessment on the material and potentially undergo further specific training with a manager. These specific training sessions were introduced to our field team in March of 2018. Within two months, instances of the issues covered in the sessions decreased overall by 20%, with some of them individually decreasing by more than 60%.

This kind of targeted training has been effective with multiple carriers. In another case, a client’s underwriting team wanted to be informed of a particular home detail as part of the inspection process. In order to ensure inspectors took special note of that detail during inspections, Millennium’s training unit implemented specific sessions on the details to observe and specific instructions regarding its notation on the inspection report. Through this exercise, the occurrence of missing that specific detail went from 2.4% to .4% in just two months.

Because different carriers, at different times, may be concerned with different, distinctive factors, their inspection needs are dynamic and individualized. In order to consistently get the results desired, your inspection provider(s) must adjust their services for you. Whether it’s targeted training or creating new inspection procedures for unique policies, a high quality, customer-focused property inspection business partner like Millennium is uniquely capable to accommodate your specific needs.

Some of the Millennium leadership team traveled to Boston this spring to discuss our advanced MAPS platform and introduce our new Self InspectR® service to some local P&C insurance carriers. After a presentation and demonstration, the group enjoyed a Red Sox game from one of Fenway Park’s pavilion suites. It was a great day with some leading industry professionals complete with baseball, fun and plenty of excitement for what Self InspectR can do for carriers.

Commercial insurers must adapt to new kinds of properties…

Some new industries with unusual insurance concerns have steadily increased in popularity in recent years. Carriers and their partners constantly have to adjust their practices to ensure they are providing the proper amount of coverage to these new, relatively unfamiliar businesses.

Some new industries with unusual insurance concerns have steadily increased in popularity in recent years. Carriers and their partners constantly have to adjust their practices to ensure they are providing the proper amount of coverage to these new, relatively unfamiliar businesses.

The burgeoning food truck industry is a prime example of a growing industry with unique insurance concerns. While these establishments have some of the same issues of concern that restaurants do, kitchen equipment, for example, there are also the same concerns associated with automobile insurance.

Food truck owners normally have to deal with a complex combination of different policies, including commercial auto, business owner, and commercial general liability insurance, to name a few. Some carriers are going so far as to even create a distinct Food Service Vehicle insurance policy to offer these kinds of businesses, in order to provide them with the right kind of coverage.

…as do personal lines carriers…

Personal lines insurers are not immune to these constant changes either. While, generally speaking, a home will always have walls and a roof, there are numerous structural and technological innovations gaining popularity amongst homeowners. For example, some home technology devices, such as water leak detectors and smart thermostats, can be beneficial when it comes to monitoring a risk and preventing major losses. In fact, these devices are now seen so positively, that some carriers are offering discounts to homeowners that utilize them. But the big question is, how do you know that they are?

It must become a part of the initial inspection process. A Millennium client decided to start offering certain benefits to smart home device users and we were able to create a set of referrals that would allow an inspector to confirm whether or not reported systems were, in fact, being utilized in a home.

It must become a part of the initial inspection process. A Millennium client decided to start offering certain benefits to smart home device users and we were able to create a set of referrals that would allow an inspector to confirm whether or not reported systems were, in fact, being utilized in a home.

With these new kinds of policy types and home technologies, must also come a new approach to those inspections.

…but how?

Take the earlier example of food trucks. Carriers need to know the same type of information about these businesses that they do for any other commercial auto policy. At the same time, it’s vital they also receive a lot of the same information gathered during a commercial food survey. Doing two separate types of inspections for one business is not a good use of a carrier’s time or money. For example, a food truck will not have the same types of alarms or security systems as a brick and mortar restaurant, but it will have some of the same kitchen concerns. Their partners need to give carriers the facts they need to underwrite for that specific business, without superfluous or unnecessary information, including results of an inspection that is not an exact fit for that business type.

Furthermore, vendors must be aware of all other new property innovations, like the smart home devices discussed earlier, that may affect how a carrier views that policy. Inspection services must provide adequate training for inspectors to recognize these new innovations, as well as confirm that information and relay it to the carrier.

To ensure carriers receive the right, specific information they need for each kind of policy, vendors need to adapt their inspection forms to match these unique structures and businesses. It’s vital to take into account the distinctive combination of issues these unique properties have, in order to efficiently get that necessary information to the carrier.

How do carriers get accurate, complete information about the properties they insure, while still giving their customers a positive, noninvasive experience? Insurance companies are in a unique, sometimes challenging, situation in that they want to provide accurate and adequate coverage, while also attempting to create a positive and unobtrusive process for their customers. Evaluating certain aspects of a home’s interior, such as the electric, heating or plumbing configurations, is necessary in some circumstances, making entering a policyholder’s home unavoidable… that is, until now!

Consumers have been able to use their “smart” phones for completing most any purchasing, banking or data sharing activity today. Through recent innovations created by Millennium, they are now also able to use their phones to mitigate the need for an inspector to enter their home. Millennium’s new Self InspectR® service gives homeowners the ability to submit qualified interior images, which are required by the carrier for underwriting, and in certain circumstances, to have those images linked directly to an exterior inspection which may have been performed simultaneously by a qualified surveyor. This linkage allows the carrier’s underwriters to review and make an underwriting decision utilizing all of the property survey information at one time.

Consumers have been able to use their “smart” phones for completing most any purchasing, banking or data sharing activity today. Through recent innovations created by Millennium, they are now also able to use their phones to mitigate the need for an inspector to enter their home. Millennium’s new Self InspectR® service gives homeowners the ability to submit qualified interior images, which are required by the carrier for underwriting, and in certain circumstances, to have those images linked directly to an exterior inspection which may have been performed simultaneously by a qualified surveyor. This linkage allows the carrier’s underwriters to review and make an underwriting decision utilizing all of the property survey information at one time.

Self InspectR is a particularly ideal solution for a homeowner whose ability to establish a mutually agreeable appointment time is limited, such as those with seasonal or vacation properties. Self InspectR gives policyholders that choice and lets them utilize an innovative, yet user-friendly, technology to complete the inspection process.

Self InspectR can be used on a “smart” cell phone or tablet device equipped with a camera. And, to mitigate concerns regarding storage space usage on a consumer’s device, as well as data security, Self InspectR does not require a policyholder to download any kind of application or program; rather, the device’s own web browser is employed to instruct the homeowner and capture images.

How does it work?

The process is simple. An email is sent to the homeowner making them aware that the Self InspectR option is available, and a link to select it. After electing to use this service, the homeowner will answer a short series of simple questions about their home before being asked to take the required photos. When they are prepared to take one of the required images, Self InspectR provides them with both a sample photo of the object and step by step instructions to ensure they provide an accurate and high-quality photo for the carrier. Once submitted, the images are reviewed by Millennium’s property specialists to validate image content and identify property hazards and conditions.

In addition to the customer satisfaction benefits related to eliminating the intrusion and time imposition associated with homeowner appointments, Self InspectR provides carriers the underwriting information they need in a much quicker time frame. This, coupled with the built-in workflow automation of Millennium’s MAPS inspection platform, creates an optimally efficient and well-documented workflow for interior inspections, while simultaneously fostering a more flexible and pleasant experience for policyholders.

If you are interested in learning more about Self InspectR, or in seeing a live demo of the platform, please contact us at MillenniumVantage@millinfo.com

As every insurance carrier pursues market opportunities, they take on new challenges for their underwriters. Suffice it to say, one size does not fit all when it comes to inspections. Very few vendor partners are well positioned to assist carriers with these challenges. However, with a veteran staff of insurance professionals, Millennium Information Services is well prepared to identify and solve those new issues with confidence.

Get Information You Need

Whether a carrier expands into a new geographic area or sees a change in their customer’s behavior, adapting their inspection process is critical. Insurance carriers do not just need to understand the changes developing within their customer base. They also need to be able to gather specific data on how these changes are affecting the risks they insure.

Urban Areas: Rehabbed Homes

A Millennium client that specifically covers urban areas, which are primarily made up of older homes, needed additional insight into these risks. These homes are often either in need of updating or have already undergone full rehabs. This client hoped to avoid major losses through high-risk homes in need of updating. Originally, this client attempted to get the information they needed through an Electrical Heating and Plumbing supplement. Although this provided significant details regarding these systems, the carrier needed specific information which would indicate prior rehabilitation efforts. To meet this need, Millennium created an entirely new supplement, designed to fit their specifications and inform underwriters if a home has been extensively remodeled recently. The ability to designate rehabbed homes from those in need of updating allowed this client to offer discounts or other incentives to homeowners with lower risk dwellings.

High-Value Homes: Technology Early Adopters

Some new client opportunities are not geographic but are instead based on consumer demographics that a carrier may choose to target. With advances in home protection devices, many carriers are now considering, if not already providing discounts and incentives to homeowners who are embracing the latest home technologies, especially devices like temperature and flood monitors.

One of Millennium’s carriers who provide sophisticated coverages to mid and high-value homes needed to verify their customer’s utilization of protective smart home devices. Millennium was able to incorporate the identification of this type of technology into our inspection process specifically for that client with new smart home referrals. These referrals alert this carrier when a homeowner has implemented some of these devices so they can apply policy incentives for select policyholders.

Specific Underwriting Guidelines: Highly Scrutinized Inspections

While some carriers may not have demographic or geographic needs that warrant a specific solution, many still have very specific underwriting guidelines to which their inspection vendors need to adhere. For example, while Millennium’s commercial inspection forms cover all the critical data points needed to properly rate these risks, carriers need inspectors and quality review staff to observe a set of guidelines specific to their requirements. For this particular need, Millennium field management maintains specialized inspector training for each carrier program and provides details regarding the specific requirements of each client to ensure that the carrier specific instructions are understood and applied uniformly in the field and by our quality review team.

Each time an insurance company pursues new market opportunities, their underwriters will face new challenges. To be effective business partners, their vendors need to be prepared to help develop solutions and strategies to meet those challenges with confidence. Millennium Information Services has a staff with decades of underwriting experience and is able to provide carriers with solutions to every unique challenge they face.

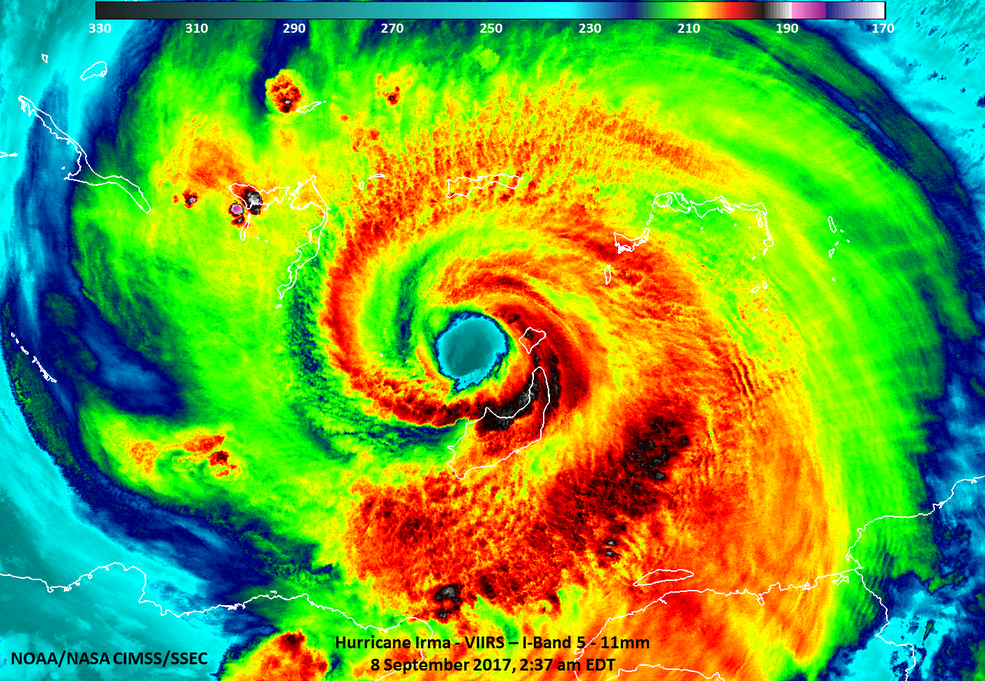

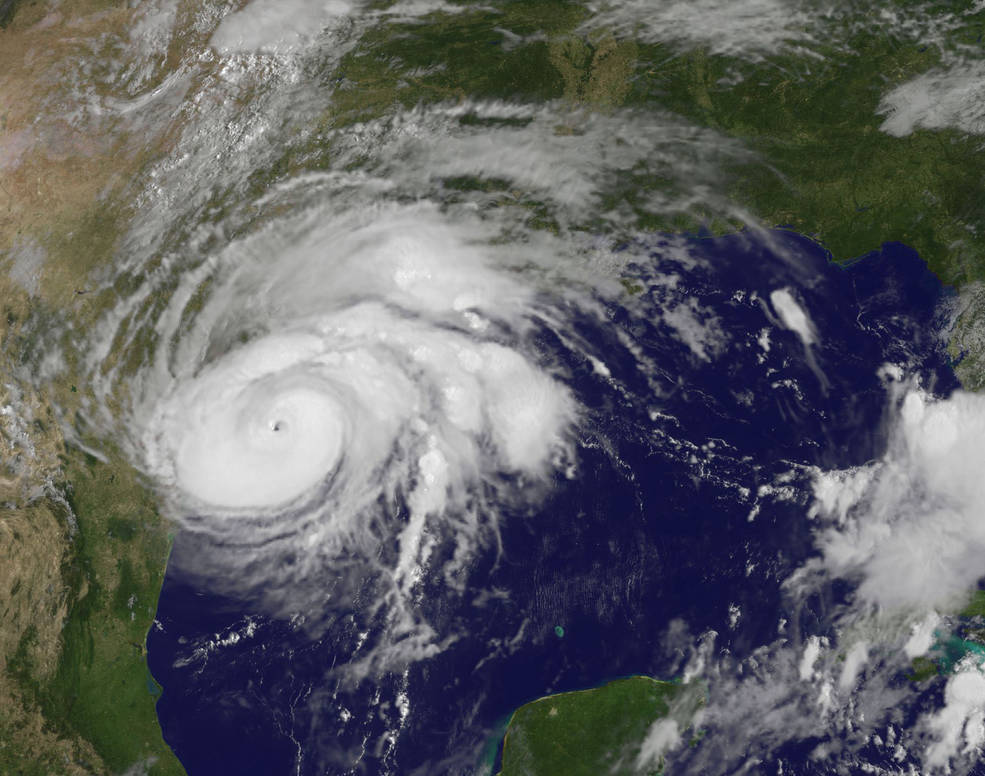

In the past three weeks, two hurricanes have devastated the Caribbean, Texas and Florida, along with other parts of the United States. Last week Hurricane Irma killed at least 26 people in Cuba before even reaching the Florida coast. Irma, which was downgraded to a tropical storm Monday morning, triggered evacuation orders for more than 5 million people in the Florida Keys and Marco Island before it hit the state over the weekend. Authorities say that the full extent of the devastation is still unknown as many islands that have been hit hardest cannot yet be accessed.

In the past three weeks, two hurricanes have devastated the Caribbean, Texas and Florida, along with other parts of the United States. Last week Hurricane Irma killed at least 26 people in Cuba before even reaching the Florida coast. Irma, which was downgraded to a tropical storm Monday morning, triggered evacuation orders for more than 5 million people in the Florida Keys and Marco Island before it hit the state over the weekend. Authorities say that the full extent of the devastation is still unknown as many islands that have been hit hardest cannot yet be accessed.

To date, this is the first year that the continental United States was hit with two Category 4 hurricanes in the same year. The National Weather Service released a statement Monday that numerous states still need to brace for Irma, including Georgia, Alabama and Tennessee.

To help those affected by Hurricane Irma, Millennium Information Services is supporting the relief efforts in Florida of Samaritan’s Purse and The American Red Cross.

Still bearing down on the southeast portion of the country, meteorologists are calling the impact of Hurricane Harvey catastrophic. Here are a few important things to know about the storm to keep in mind.

Still bearing down on the southeast portion of the country, meteorologists are calling the impact of Hurricane Harvey catastrophic. Here are a few important things to know about the storm to keep in mind.

- As of Monday morning, between 15 and 25 more inches of rainfall is expected across the Texas coast, with isolated storm totals as high as 50 inches.

- There is also a threat of tornadoes in the coastal areas of Texas, along with the rainfall.

- Over the weekend, every major roadway in the Houston area was flooded with more than 15 feet of water in some places.

- Meteorologists have reported that the storm may even reintensify during the beginning of this week.

- The flood threat has now spread farther East into Louisiana, with as much as 15-25 inches of rainfall expected in the southwest part of the state.

- During these types of storms, contamination of clean water is a large concern. So an adequate supply of drinking water is crucial for residents in affected areas

- FEMA officials say that they are prepared to be in Houston “for years” dealing with the aftermath of Hurricane Harvey.

- As of Monday morning, more than 300,000 people in Texas were reported without power.

- The storm will most likely have a large impact on numerous agriculture sectors in affected areas, including cotton, corn, and soybeans.

To help those affected by Hurricane Harvey, Millennium has contributed to the recovery efforts in Texas through Feeding Texas and Samaritan’s Purse. You can follow the links to find out how you can help.

How can images gathered via satellite be effectively used by underwriters?

Advances in satellite imagery have increased over the past 15 years, particularly within the last several years as the technology has drastically improved the clarity and quality of images. While those improvements have made the usage of aerial imagery more acceptable in the property and casualty insurance industry, in many circumstances, such as newer or recently updated homes, or those located in less populated areas, it remains insufficient to properly underwrite a risk. The details of home construction and accuracy of conditions and hazards on a property really require boots on the ground in the form of an experienced property inspector.

Satellite images typically lack the close-proximity photos on conditions which underwriters require in order to take action, nor can they identify issues like aggressive dog breeds, trip and fall hazards, the true occupancy of a property, and issues with surrounding trees, among others.

A major concern to all carriers needs to the the timeliness of images that they are utilizing. Different aerial image distributors provide significantly different frequency of updates to their images. The two photos below are examples of the same house available through two different providers. There are a number of apparent differences that would impact an underwriter’s perspective and their determination of this h0me.

The first photo shows a much larger rear porch and a smaller living area, while the second photo has a clear addition to both the front and rear of the home, increasing the TLA, as well as an expansion of the gable roof and a decrease in the rear flat roof. Additionally the lack of clarity in the second photo makes it very difficult to see any issues with trees overhanging.

The first photo shows a much larger rear porch and a smaller living area, while the second photo has a clear addition to both the front and rear of the home, increasing the TLA, as well as an expansion of the gable roof and a decrease in the rear flat roof. Additionally the lack of clarity in the second photo makes it very difficult to see any issues with trees overhanging.

Contrastingly, in the first photo, the very clear issue with trees overhanging the left side of the home could be hiding an additional porch or any number of other hazards.

Contrastingly, in the first photo, the very clear issue with trees overhanging the left side of the home could be hiding an additional porch or any number of other hazards.

Finally the quality of both pictures make it impossible to determine the estimated life and adverse condition of the roof, the leading source of claims for insurers; that information is absolutely critical, and is only available at this point through a physical inspection.

Aerial imagery can be useful in situations where accessing the property is limited, such as accessing areas behind privacy fences, or for validating the relative wall dimensions gathered during an inspection.

Recognizing the benefits and limitations of aerial imagery is critically important for carriers to developing a successful underwriting strategy which utilizes them.

How can you make policyholders more comfortable with home inspections?

Physical inspections provide indispensable information to insurance providers. From potential hazard and condition issues, to structural changes to a home, one can simply not determine the accurate coverage amount for a property without a professional taking a look at it. Inspectors are able to determine the estimated remaining life of a roof, the occupancy status of a home and other conditions that, while invisible to the untrained eye, are crucial pieces of information to insurers. Without that up-to-date data, underwriters cannot make a fully informed decision when writing and updating policies.

Physical inspections provide indispensable information to insurance providers. From potential hazard and condition issues, to structural changes to a home, one can simply not determine the accurate coverage amount for a property without a professional taking a look at it. Inspectors are able to determine the estimated remaining life of a roof, the occupancy status of a home and other conditions that, while invisible to the untrained eye, are crucial pieces of information to insurers. Without that up-to-date data, underwriters cannot make a fully informed decision when writing and updating policies.

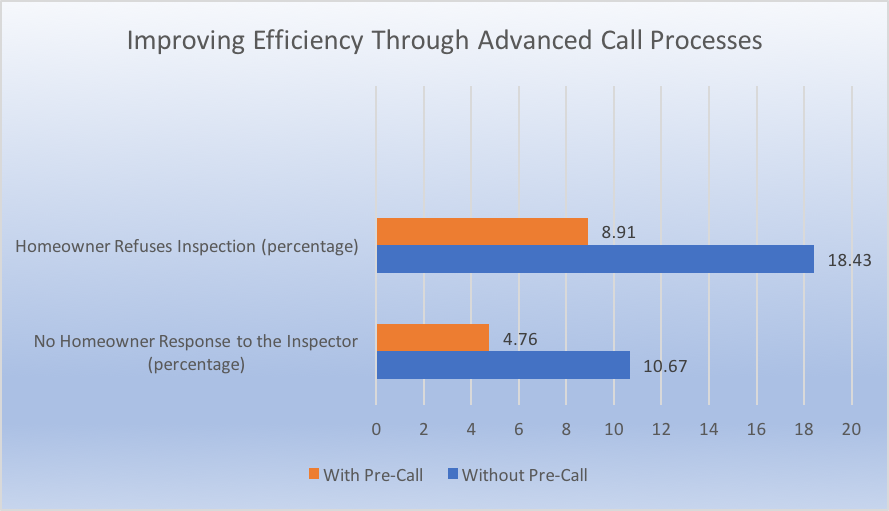

While vital to making profitable decisions, these inspections can be difficult to complete, due, in large part, to low homeowner engagement. Without a complete understanding of the inspection process, policyholders can be confused or uncomfortable by the inspector’s presence. This can lead to a reluctance to make necessary appointments, or worse, a dangerous situation for the inspector. The completion of a detailed and current inspection is dependent on the cooperation of a homeowner. It is also important as a vendor to create as positive of an experience for the policyholder as possible, resulting in an equally positive experience for their agent.

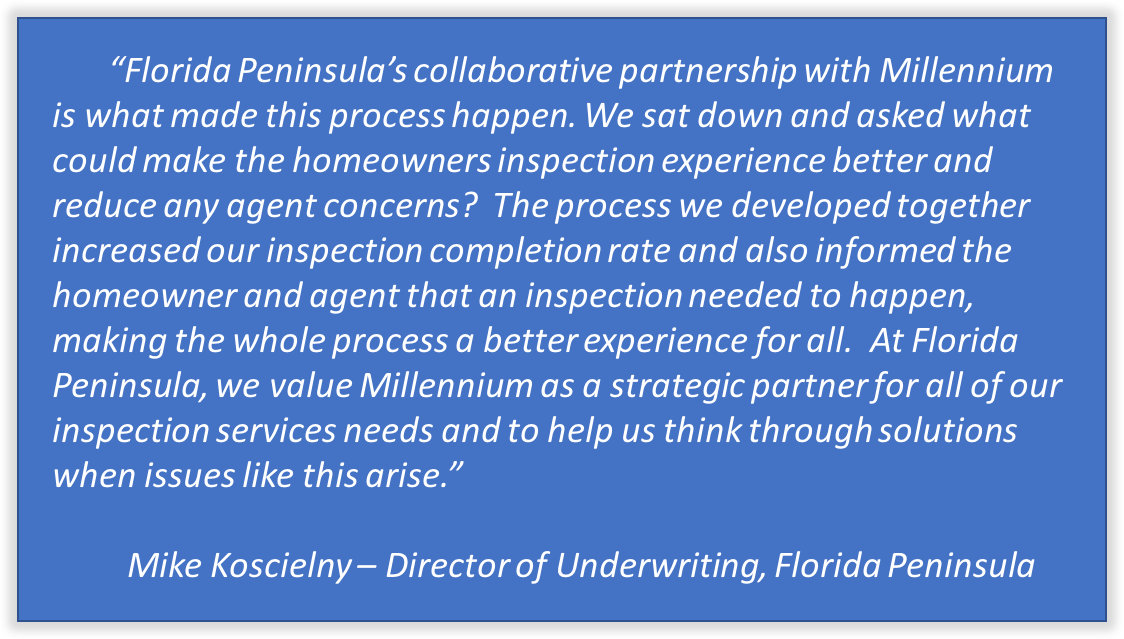

One way to improve the homeowner’s inspection experience is to educate them about what the inspection consists of and why it is being done. This is particularly important when a survey requires that the inspector photograph and take notes inside the home. In order to easily set up an appointment with a homeowner, they need to have confidence that the company and the person that they’re allowing into their home is professional, well in advance of the actual inspection. To accomplish this, Millennium Information Services worked with the management of Florida Peninsula to create a pre-inspection in-house call process, improving that experience for their homeowners.

One way to improve the homeowner’s inspection experience is to educate them about what the inspection consists of and why it is being done. This is particularly important when a survey requires that the inspector photograph and take notes inside the home. In order to easily set up an appointment with a homeowner, they need to have confidence that the company and the person that they’re allowing into their home is professional, well in advance of the actual inspection. To accomplish this, Millennium Information Services worked with the management of Florida Peninsula to create a pre-inspection in-house call process, improving that experience for their homeowners.

This process proved to not only make the inspection process more efficient, but it also made homeowners more comfortable with the inspectors. Incomplete inspections due to homeowner unavailability decreased by 51.7%. The advanced notice and better understanding of the inspection process also reduced policyholder complaints about inspectors by 51.4% All of these results show that increased homeowner engagement not only improves the completion rate of inspections, but it also makes for a much better inspection experience for homeowners.

First homeowners, then agents.

It’s important to also create a positive experience for the agents involved. In the case of Florida Peninsula, agents were new to this advanced call process as well. To help ease the concerns of agents involved in the process, Millennium management traveled to Florida and met with them as a group to provide details as to how the pre-notification process works, and obtain feedback on the program’s success. This meeting allowed agents to gain an understanding of the process, ask questions and to have all of their concerns addressed.

In another situation, Millennium has been able to increase agent engagement in a policy renewal inspection process through the delivery of daily notification emails. After receiving inspection orders from the carrier, Millennium sends all agents associated with those policies an email that lists each policyholder whose home will be subject to an inspection during that period. This advanced notice prepares agents for any questions they might get from their customers and helps to facilitate a smooth line of communication between all three parties.

Effective, early communication with homeowners can be completed in many different ways. Another Millennium client had an issue with policyholders being confused by the inspection process, leading to a high number of inspection refusals. To help those homeowners become more comfortable, Millennium created an informational sheet that agents could give to policyholders explaining why inspections are done and how that process works. This pre-inspection education and coordination between Millennium, the agents and the homeowners led to a decrease in incomplete inspections for that client and significantly improved the policyholder’s perception of the process.

Millennium Information Services, Inc. is always looking for ways to enhance the inspection experience for both insurance providers and their customers, particularly through increased homeowner engagement. The more educated both the policyholders and their agents are with what we do, the more comfortable they will be with the entire inspection process. That higher level of comfort allows Millennium to provide our clients with the most efficient service possible, while delivering the type of comprehensive home evaluation needed to create a profitable book of business.