Impact of Construction Costs on a Renewal Book of Business

Construction costs and home prices have clearly increased in the past few years. According to the Federal Housing Finance Agency home prices rose 6.2% from Q4 2015 to Q4 2016. While that increase is in part due to a rise in building costs, evidence shows that there is also a shortage of skilled labor, particularly in the commercial construction sector.

Construction costs and home prices have clearly increased in the past few years. According to the Federal Housing Finance Agency home prices rose 6.2% from Q4 2015 to Q4 2016. While that increase is in part due to a rise in building costs, evidence shows that there is also a shortage of skilled labor, particularly in the commercial construction sector.

Many of the replacement cost companies sell indexes, or “inflation guards,” that insurance companies apply universally across their entire book of renewal business, usually by 3-digit zip code. While this seems like a logical approach to the rising costs of construction, there is simply not that kind of uniformity when it comes to property insurance.

Several years ago, when oil prices were at an all-time high, petroleum based products rose much faster than most other building material. Therefore, roof replacement costs were very different depending on the materials used. Labor in the oil patch state of North Dakota was scare and very expensive during the latest oil boom. Did the 3-digit zip adequately cover the differences in labor cost? The short answer is no. Building costs may ebb and flow, but they mostly go up. After a few quarters of applying inflation indexes, your renewal book of business could be significantly underinsured.

One way to approach this issue is with individualized inspections. The data gathered by actually going to a residential or commercial property is invaluable when updating that property’s replacement cost. These inspections not only help create the most accurate insurance-to-value (ITV), but it will also give insurers a clear and current list of conditions and hazards for each and every property. (How else can an insurer truly know whether or not a policy is worthy of keeping on the books?) Although this will provide the most comprehensive evaluation, there are practical considerations of performing a book-wide evaluation, not the least of which are the cost of the inspections and the internal resources necessary to process actionable findings.

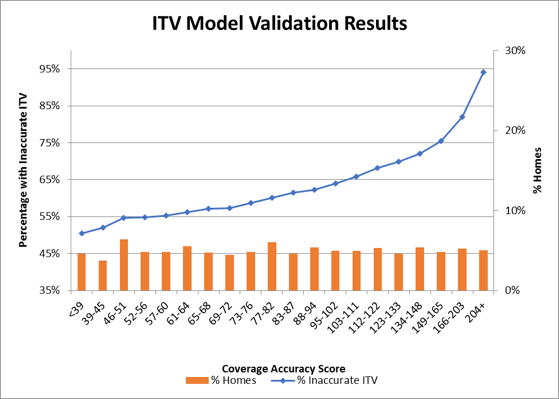

At Millennium, we understand this dilemma and that is why we’ve developed our PreInspectR® optimization tool. Our clients can utilize this tool to score an entire book of business and to focus their efforts, and expenses on those properties which are most likely have the worst conditions and hazards. Additionally, the PreInspectR® model also provides a score that identifies those properties that are most likely to have ITV issues. Depending on the level of interest in focusing on proper valuations or the existence of hazards, either or both PreInspectR® scores can be used to determine which properties should be inspected. Actionable rates for those properties inspected that were identified by a higher PreInspectR® scores can be as high as 80%.

At Millennium, we understand this dilemma and that is why we’ve developed our PreInspectR® optimization tool. Our clients can utilize this tool to score an entire book of business and to focus their efforts, and expenses on those properties which are most likely have the worst conditions and hazards. Additionally, the PreInspectR® model also provides a score that identifies those properties that are most likely to have ITV issues. Depending on the level of interest in focusing on proper valuations or the existence of hazards, either or both PreInspectR® scores can be used to determine which properties should be inspected. Actionable rates for those properties inspected that were identified by a higher PreInspectR® scores can be as high as 80%.

Our “one size does NOT fit all” approach has been well received by our clients and helps them identify properties that are either no longer an acceptable risk or that are in need of repair. It also tells them what properties are underinsured by applying the proper coverage amount, helping fund the renewal book examination and ensuring adequate coverage.