How can you make policyholders more comfortable with home inspections?

Physical inspections provide indispensable information to insurance providers. From potential hazard and condition issues, to structural changes to a home, one can simply not determine the accurate coverage amount for a property without a professional taking a look at it. Inspectors are able to determine the estimated remaining life of a roof, the occupancy status of a home and other conditions that, while invisible to the untrained eye, are crucial pieces of information to insurers. Without that up-to-date data, underwriters cannot make a fully informed decision when writing and updating policies.

Physical inspections provide indispensable information to insurance providers. From potential hazard and condition issues, to structural changes to a home, one can simply not determine the accurate coverage amount for a property without a professional taking a look at it. Inspectors are able to determine the estimated remaining life of a roof, the occupancy status of a home and other conditions that, while invisible to the untrained eye, are crucial pieces of information to insurers. Without that up-to-date data, underwriters cannot make a fully informed decision when writing and updating policies.

While vital to making profitable decisions, these inspections can be difficult to complete, due, in large part, to low homeowner engagement. Without a complete understanding of the inspection process, policyholders can be confused or uncomfortable by the inspector’s presence. This can lead to a reluctance to make necessary appointments, or worse, a dangerous situation for the inspector. The completion of a detailed and current inspection is dependent on the cooperation of a homeowner. It is also important as a vendor to create as positive of an experience for the policyholder as possible, resulting in an equally positive experience for their agent.

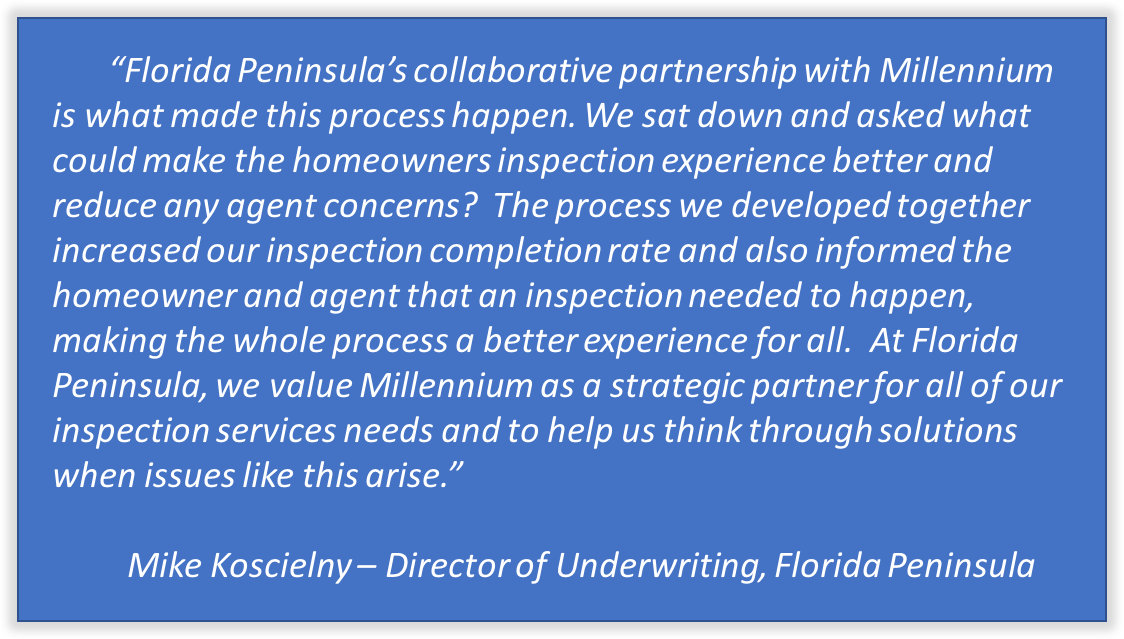

One way to improve the homeowner’s inspection experience is to educate them about what the inspection consists of and why it is being done. This is particularly important when a survey requires that the inspector photograph and take notes inside the home. In order to easily set up an appointment with a homeowner, they need to have confidence that the company and the person that they’re allowing into their home is professional, well in advance of the actual inspection. To accomplish this, Millennium Information Services worked with the management of Florida Peninsula to create a pre-inspection in-house call process, improving that experience for their homeowners.

One way to improve the homeowner’s inspection experience is to educate them about what the inspection consists of and why it is being done. This is particularly important when a survey requires that the inspector photograph and take notes inside the home. In order to easily set up an appointment with a homeowner, they need to have confidence that the company and the person that they’re allowing into their home is professional, well in advance of the actual inspection. To accomplish this, Millennium Information Services worked with the management of Florida Peninsula to create a pre-inspection in-house call process, improving that experience for their homeowners.

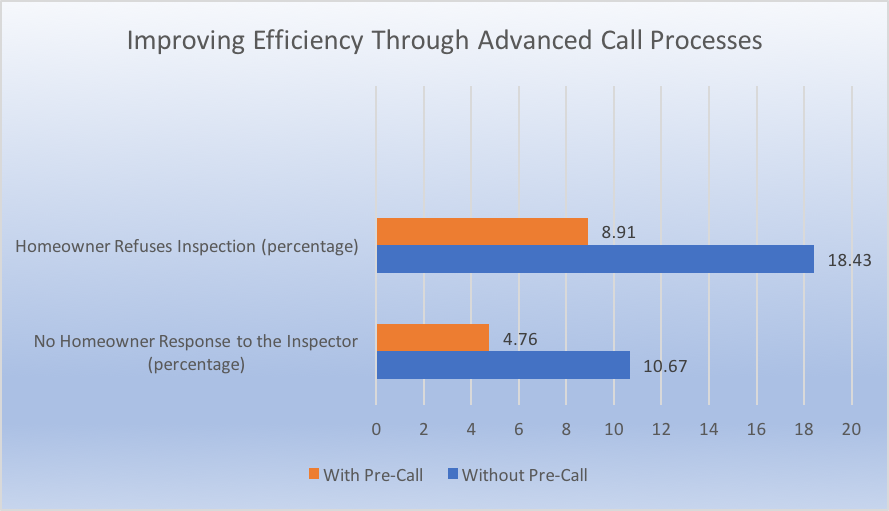

This process proved to not only make the inspection process more efficient, but it also made homeowners more comfortable with the inspectors. Incomplete inspections due to homeowner unavailability decreased by 51.7%. The advanced notice and better understanding of the inspection process also reduced policyholder complaints about inspectors by 51.4% All of these results show that increased homeowner engagement not only improves the completion rate of inspections, but it also makes for a much better inspection experience for homeowners.

First homeowners, then agents.

It’s important to also create a positive experience for the agents involved. In the case of Florida Peninsula, agents were new to this advanced call process as well. To help ease the concerns of agents involved in the process, Millennium management traveled to Florida and met with them as a group to provide details as to how the pre-notification process works, and obtain feedback on the program’s success. This meeting allowed agents to gain an understanding of the process, ask questions and to have all of their concerns addressed.

In another situation, Millennium has been able to increase agent engagement in a policy renewal inspection process through the delivery of daily notification emails. After receiving inspection orders from the carrier, Millennium sends all agents associated with those policies an email that lists each policyholder whose home will be subject to an inspection during that period. This advanced notice prepares agents for any questions they might get from their customers and helps to facilitate a smooth line of communication between all three parties.

Effective, early communication with homeowners can be completed in many different ways. Another Millennium client had an issue with policyholders being confused by the inspection process, leading to a high number of inspection refusals. To help those homeowners become more comfortable, Millennium created an informational sheet that agents could give to policyholders explaining why inspections are done and how that process works. This pre-inspection education and coordination between Millennium, the agents and the homeowners led to a decrease in incomplete inspections for that client and significantly improved the policyholder’s perception of the process.

Millennium Information Services, Inc. is always looking for ways to enhance the inspection experience for both insurance providers and their customers, particularly through increased homeowner engagement. The more educated both the policyholders and their agents are with what we do, the more comfortable they will be with the entire inspection process. That higher level of comfort allows Millennium to provide our clients with the most efficient service possible, while delivering the type of comprehensive home evaluation needed to create a profitable book of business.